This past Friday, the Second Circuit reversed a lower court’s denial of a motion to compel arbitration in a putative consumer class action against fintech company Klarna. Edmundson v. Klarna, Inc., Case No. 22-557-cv (2d Cir. Nov. 3, 2023). The panel upheld the enforceability of Klarna’s “click-wrap” mandatory arbitration provision incorporated in Klarna’s terms and conditions. This precedential decision comes amid a surge in putative class actions targeting online services including, for example, subscription programs subject to state auto-renewal laws. For companies that have arbitration clauses in their website user agreements, Edmundson is another tool in the kit to help deter and defeat class actions.

The enforceability of an arbitration clause is a question of contract law and turns on whether the parties assented to the contractual terms. Plaintiffs in these types of cases involving online clickwrap provisions—where consumers accept terms by clicking a button or checking a box—often argue a lack of mutual assent on the basis that the terms of service containing the arbitration clause were allegedly not clearly visible. But the Second Circuit maintains that even absent evidence that a consumer had actual knowledge of the clickwrap terms, the consumer will be bound if (1) notice of the terms was displayed conspicuously enough such that a reasonably prudent person would be on inquiry notice of the terms, and (2) the consumer unambiguously manifests assent through conduct that a reasonable person would understand to constitute assent.

Klarna is a web service that offers shoppers the option to “buy now, pay later.” Plaintiff filed a putative class action alleging that Klarna misrepresented and concealed the risk of facing bank overdraft fees when using that service. When signing up for Klarna’s service, consumers are asked to assent to Klarna’s terms of service, which include a mandatory arbitration clause. Klarna moved to arbitrate plaintiff’s claims, alleging that plaintiff agreed to Klarna’s terms of service at various different points, including when she used a Klarna checkout “Widget” to finalize an online purchase. The district court denied Klarna’s motion to arbitrate, finding that plaintiff did not have reasonably conspicuous notice of and did not unambiguously manifest assent to Klarna’s terms of service, and therefore plaintiff was not bound by the mandatory arbitration clause in those service terms. The Second Circuit reversed and upheld the enforceability of Klarna’s arbitration clause.

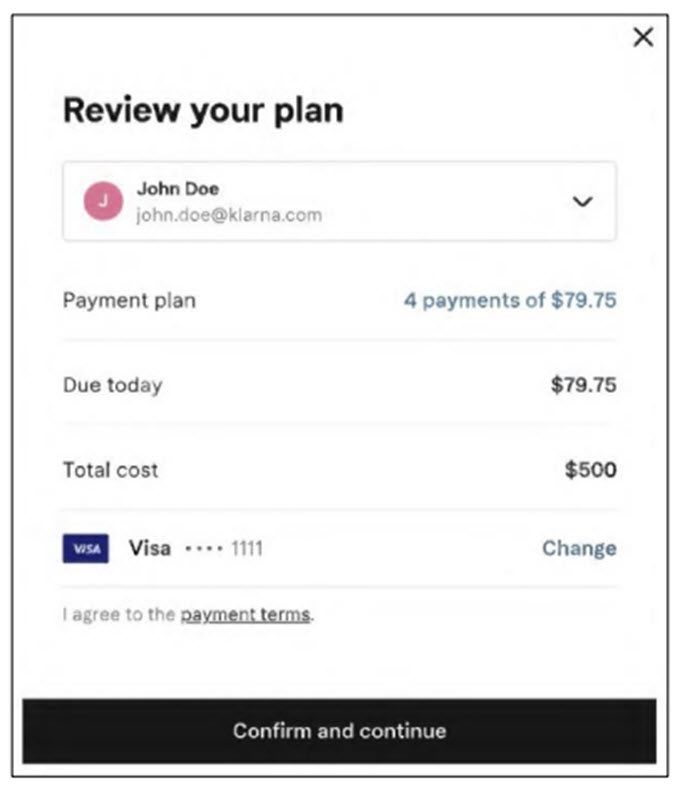

First, the panel found the Klarna Widget provided reasonably conspicuous notice of Klarna’s terms of service (and thus the arbitration clause contained therein), sufficient to provide inquiry notice. The Court emphasized that the Widget interface, shown below, is “uncluttered,” the only link it provides is to Klarna’s terms of service, and the consumer is presented with only one button to click: “Confirm and continue.”

The Court noted that this content was all “visible at once,” without needing to scroll down to find notice of Klarna’s payment terms, and since the hyperlink appears directly above the “Confirm and continue” button, a reasonable internet user “could not avoid noticing the hyperlink to Klarna’s terms when the user selects ‘Confirm and continue’ on the Klarna Widget.” The Court further noted that the hyperlink to the terms is set apart from the surrounding information by being underlined and in a color that stands in sharp contrast to the background.

Second, the Court found that plaintiff unambiguously manifested assent to the terms of service by clicking the Widget button to “Confirm and continue.” Specifically, the Court found that reasonable internet users would understand that clicking that button constitutes confirmation that they “agree to the payment terms” as stated conspicuously directly above the button. Conversely, it would be unreasonable for an internet user to see the clear and conspicuous statement, “I agree to the payment terms,” with the button marked “Confirm and continue” directly under it, and not understand that the button is the mechanism by which the user confirms his or her agreement to the linked terms. The Court also pointed to the fact that plaintiff “could not have reasonably believed that the information set forth on the Klarna Widget above the hyperlinked ‘payment terms’ represented all the terms governing her use of Klarna’s service,” and therefore was on inquiry notice that her “agree[ment] to the payment terms” necessarily encompassed more, “and the burden was then on her to find out to what terms she was accepting.” The Court thus held that plaintiff “unambiguously manifested her assent to Klarna’s terms” and, “as a matter of law, [plaintiff] agreed to arbitrate her claims against Klarna.”

The Second Circuit’s decision in Edmundson could not come at a better time for companies who provide online services, including those with auto-renewing subscription programs. Class actions targeting such services have been on the rise, with plaintiffs’ attorneys demanding unrealistic levels of conspicuousness for hyperlinked terms of service. This decision rejects the plaintiffs’ bar’s extreme position and confirms that the practices employed by many companies suffice to put reasonable consumers on notice that they are agreeing to terms of service—including arbitration clauses contained therein—by proceeding with a transaction. Of course, whether arbitration clauses are best for your business should be assessed with counsel, to weigh their benefits against the risk of mass arbitrations.

***

Want to talk advertising? We welcome your questions, ideas, and thoughts on our posts. Email or call us at bvinti@proskauer.com /212-969-3249