Proskauer and Deloitte convened health care industry leaders to discuss important developments in health care M&A and the regulatory and legislative landscape facing the industry in 2018. These are the seven key takeaways:

1. Powerful forces are driving disruption

The pace and scope of health care deals are only two dimensions of broad-based disruption across the industry. Rapid changes are taking place in the areas of digital health management, consumerism, on-demand pharmacies, retail experiences, greater price transparency and many others.

An even bigger story is how heavyweight investors from outside the health care sector – particularly the unlikely allies of J.P. Morgan, Berkshire Hathaway and Amazon – are making moves to disrupt and reshape the health industry with the aim of making the industry more cost-effective and efficient.

2. New entrants and novel combinations are shaking things up

Consolidation continues as players seek scale and access to new markets. There has been an increasing number of cross-sector combinations, both through vertical

integration and expansion of capabilities across traditionally separate sectors.

Expected Consolidation

The provider sector is poised for significant consolidation in the next decade.

New entrants – including big brands with vast resources – are causing further disruption. For example, Amazon is taking steps toward drug and device distribution and Apple is working Health Record EHR Patient Data Viewer. Those two giants, along with Google, are developing data and analysis solutions for health care as well. We can expect more innovation and disruption for such players in the coming years.

3. More money is in play, driving historic deal activity

Health care spending in the U.S. continues to rise. It’s now over $3.5 trillion in the U.S., representing 18% of GDP. What’s more, Centers for Medicare & Medicaid Services predicts that it will surpass 20% of GDP by 2025. Meanwhile, for the first time in 2017, health care sector employment surpassed that of both retail and manufacturing.

This growth in spending and industry employment has been accompanied by an increase in the amount and speed of capital coming into the sector. In 2017, both health care and overall private equity deal values surged to the highest levels since 2007. Health care deals comprised 18% of the number of deals, representing $43 billion in value.

4. Deals are about building scale and (sometimes) driving efficiency and quality

The focus of much of the recent M&A activity has been on driving scale, rather than pursuing cost reductions. On the buy side, the driving force is to gain leverage as a means to negotiate with payers, enhance revenue and, sometimes, to cut costs. Another goal is to increase geographic coverage.

2017 was a record year for M&A activity among providers – with 988 reported transactions across all provider entities. The provider sector is poised for ever-greater consolidation in the next decade.

5. Private Equity interest remains strong despite high valuations and regulatory uncertainty

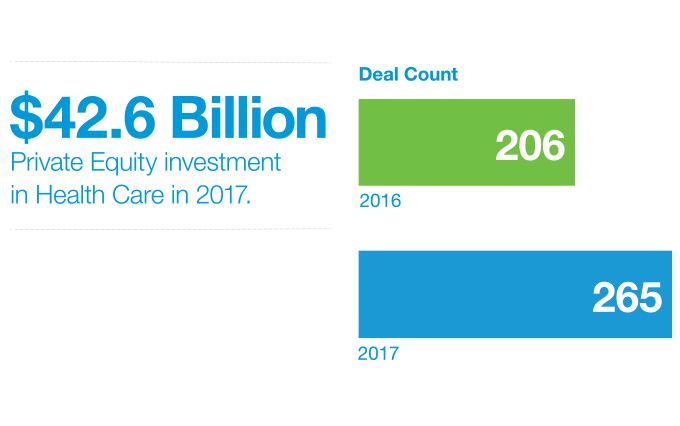

Despite high valuations in the marketplace, private equity investment has maintained its vigor, with an abundance of available capital that has kept the market tipped in the seller’s favor. Bain reported that the total disclosed deal value of private equity investment in health care in 2017 was $42.6 billion, which was up 17% over 2016, and was the highest level since 2007. The deal count rose to 265 in 2017 (from 206 in 2016).

Competition for deals may, in fact, represent a larger hurdle than regulators, which have not shown signs of increasing the level of scrutiny – or likelihood of rejection – of deals in the sector.

6. Value-based payment models, population health remain attractive to investors

Like a scene from The Empire Strikes Back, major industry players have shown that they’re still a match for the onslaught of disruptive forces, from new competitors to breakthrough technologies.

The shift from fee-for-service models to value-based models in the industry continues, driving greater investment interest even as challenges persist in accurately determining revenue and expense factors. Private equity remains interested in technologies that can increase value and improve outcomes by leveraging data.

7. Midterm elections and budget pressures impact D.C. health policy

All eyes are on the midterms. If Democrats win narrow control of the U.S. House, we can expect health system stabilization efforts and maybe even a push for a national reinsurance plan. But, if the GOP keeps control, ACA repeal could be back on the table, with a bill that gives states more flexibility in coverage design and benefits.

The U.S. Department of Health and Human Services is pushing insurers and pharmacy benefits managers to get more aggressive in managing drug prices for consumers, signaling greater scrutiny of rebates and more granular reporting requirements. Expect potentially greater formulary flexibility in Medicare.

Conclusion

The busy health care deal market reflects a dynamic industry undergoing seismic change. Pressure from employers and government for more value-based payment arrangements is leading to new alliances across sectors in an effort to produce better outcomes, lower costs and higher patient satisfaction. Beyond joining forces with others to acquire new capabilities, health care companies are combining to achieve the scale that gives them more influence with purchasers, suppliers and consumers of their products and services. Disruptive new entrants to the marketplace – including Amazon, Apple and Alphabet (Google) – represent both potential partners and threats to industry incumbents. All of this transformation is being fueled by virtually limitless capital from private equity investors and lenders and the public capital markets, and, for the moment, policymakers appear content to let the private market determine winners and losers. Tighten your seat belt and hold on tight.