Last week, the Departments of Labor, Treasury, and Health and Human Services finalized regulations implementing the Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA). Although the final regulations step back from certain burdensome aspects of the proposed rules (which we blogged about here), compliance with the final rules will require action from virtually all group health plans that cover mental health and substance use disorder (MH/SUD) benefits before the end of the year.

How did we get here?

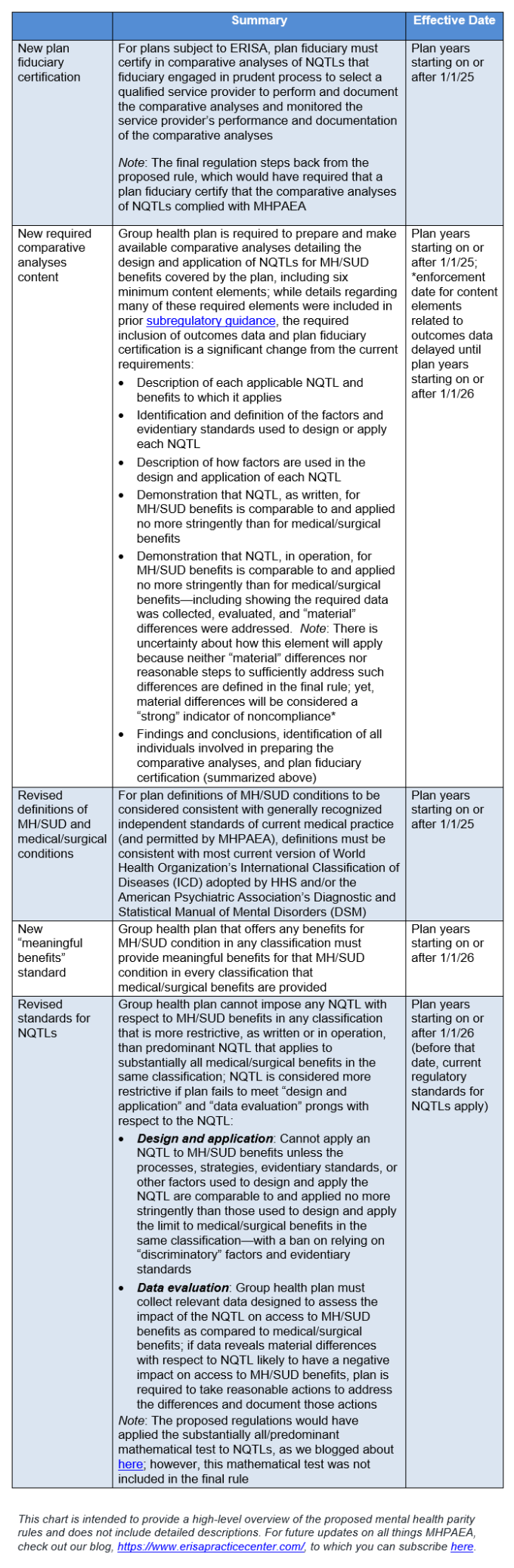

MHPAEA requires that group health plans that provide MH/SUD benefits cover them in parity with medical and surgical benefits. Evaluation of whether benefits are in parity is performed for each classification of benefits under the plan, and this analysis requires evaluating: (1) financial and other quantitative treatment limitations, and (2) non-quantitative treatment limitations (NQTLs). At the end of 2020, Congress added a requirement that group health plans document their comparative analyses for NQTLs applied to MH/SUD benefits and make the comparative analyses available upon request to regulators.

What are the significant changes in the final MHPAEA regulations compared to the current regulations?

What are the implications of the final regulations for network composition?

The Departments have remained focused on NQTLs related to network composition (e.g., provider and facility network admission standards, credentialing standards, and reimbursement rate methodology) throughout this rulemaking process. The final regulations do not include the proposal that outcomes data for NQTLs related to network composition showing material differences in access would automatically be deemed to violate MHPAEA. However, the final regulations make clear that plan sponsors are expected to take significant steps to address such material differences, including by: (1) strengthening efforts to recruit mental health providers to a network (such as by increasing provider reimbursement rates); (2) expanding telehealth availability; (3) providing outreach to participants to help them find in-network providers; and (4) ensuring provider directories are up to date.

As plan sponsors might surmise, compliance with this part of the final regulations may prove to be somewhat of a moving target and will likely require significant plan sponsor investment to ensure compliance. Although the Departments had issued a proposed safe harbor regarding NQTLs for network composition, that safe harbor was not finalized as part of the final regulations, and the Departments have indicated they are still reviewing the comments they received in response to the proposal.

Timing takeaways for group health plan sponsors?

Since the final rules were released last week, several advocacy groups have indicated they are weighing the possibility of filing a lawsuit to set aside certain portions of the final rule on the basis it exceeds the regulatory authority of the Departments (in particular, the new “meaningful benefits” standard and outcomes data requirements, which would be effective starting in 2026). It’s hard to predict the outcome and speed at which such litigation might proceed, and whether the court’s decision would impact any portions of the rule set to take effect in 2025. For that reason, some plan sponsors may choose to focus on compliance deadlines with a 2025 effective date for now (which is plenty to address on its own), and adopt a wait-and-see approach on the new requirements slated for 2026 until the outcome of any potential litigation becomes clearer.