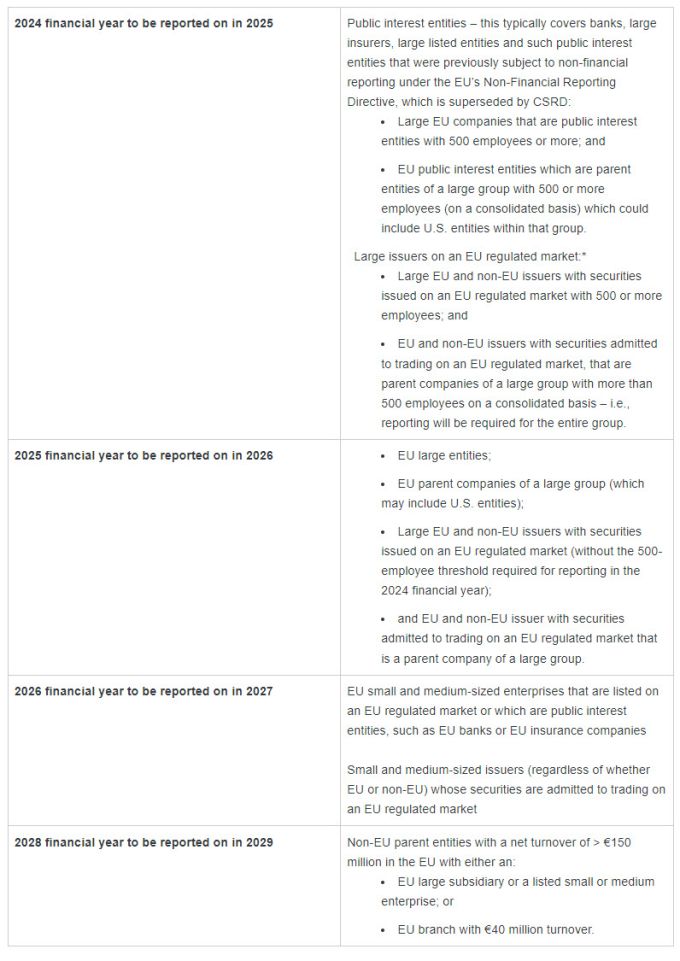

As set out in our Proskauer Special Report “Primarily Non-financial corporate reporting for U.S. companies – where to start?”, it may be complex to determine the applicability of the EU’s Corporate Sustainability Reporting Directive (“CSRD”). The following provides a more in-depth analysis regarding the applicability of CSRD. Non-EU companies, including those in the U.S., with operations in the EU may be within the scope of CSRD either on a solo basis or via a group through their subsidiaries or branches. CSRD may apply to a group simultaneously or to different parts of the group at different times.

The threshold for being within the scope of CSRD is primarily based on whether an entity is deemed “large”. This is defined as exceeding two out of the three following criteria:

- €25 million balance sheet;

- €50 million turnover; and

- 250 employees.

However, there are additional factors which also may trigger being within scope, including being listed on an EU regulated market.

Exempted from scope are alternative investment funds (“AIFs”) under the Alternative Investment Fund Managers Directive, (“AIFMD”) which may be useful for some asset managers. However, segregated accounts, co-investment, special vehicles and holding companies are not exempt, and may in each case qualify to be within the scope of CSRD. There is a prescribed list of “undertakings” that fall within scope, as set out in the EU Accounting Directive which CSRD amends, and not all expected companies/partnerships are listed – e.g., the Lux SCSp is not in that list.

*Regulated market: CSRD amends the EU’s Transparency Directive to include issuers on an EU regulated market, but this does not apply to an issuer whose securities are traded only on a multilateral trading facility (“MTF”) or for debt instruments on an organised trading facility (“OTF”).

Please contact ukreg@proskauer.com for further information on CSRD.