The direct lending market continues to grow at an explosive pace and the record sums now managed by private credit firms exceeds $770 billion (up from $275 billion in 2009) with $110 billion alone raised in 2018, according to a report from Preqin. Of course, no one knows how long the decade-long bull run that global markets have enjoyed will continue. But, with businesses carrying record levels of leverage and if default rates match the last recession’s peak of more than 10%, there can be little doubt that private credit firms will play a significant role in the next restructuring cycle.

So will the next restructuring cycle be different? Yes, and likely in several key respects. Most notably, the next cycle will be different as a result of the proliferation of borrower friendly loan documentation that has spread from the syndicated loan market to the middle market because of intense competition for deals, the volume of “dry powder” raised by private credit funds and private equity sponsors, and the flexibility of private credit funds to support a restructuring as compared to traditional bank lenders.

"Borrower Friendly Documentation"

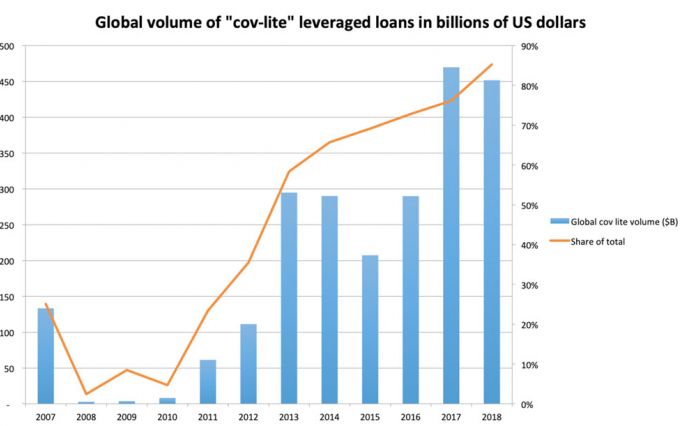

The sheer volume of capital vying for lending opportunities means borrower-friendly terms, with limited or significantly loosened covenants (i.e. "cov-loose") have become the norm as compared to the last cycle. A massive 85% of global leveraged loans are now covenant-lite, according to S&P, compared to just 23% in 2011. And an astounding total of $452 billion of new cov-lite loans were issued last year alone.

Significantly, cov-lite credit agreements are no longer restricted to the syndicated loan market. Unlike the run up to the financial crisis of over a decade ago, cov-lite deals are now present in the middle market, but even more concerning is the pervasiveness of cov-loose deals. Notably, only 60 percent of deals in Proskauer’s most recent Private Credit Insights report featured traditional financial covenants with the balance being either cov-lite or cov-loose.

This trend towards borrower friendly documentation will impact the next restructuring cycle in several ways. First, lenders will have far less control to insist on early remedial action when their borrowers begin a slide into distress for a simple reason: there are fewer and looser covenants to trigger the panoply of default-based rights and remedies. Financial covenants generally fall into two broad categories – maintenance and incurrence covenants. Maintenance covenants generally require the borrower to maintain compliance with certain financial metrics during the life of the loan. These covenants are intended to measure the borrower’s financial health and act as an early warning sign for lenders when the borrower’s business starts deteriorating. When the covenant is breached, the lender can act to protect itself and effectively force the borrower to the negotiating table. By contrast, incurrence covenants test compliance only when the borrower intends to take specified action (e.g. incur debt, sell assets, pay junior debt or declare a dividend). The proliferation of cov-lite and cov-loose loans have effectively stripped-out maintenance covenants from loan documentation and have made incurrence covenants easier to satisfy. Consequently, sponsors and borrowers can keep their lenders at bay for longer while they try to address the underlying source of distress by cutting costs, disposing of assets, acquiring businesses and/or incurring additional indebtedness to fund operations. The delay may prove costly and could impair lender recoveries if it means restructuring negotiations must happen against the backdrop of a company teetering on the brink of collapse and facing an imminent liquidity crisis. Thus, it will be important for lenders to be proactive by asking questions and actively communicating with borrowers and sponsors when trends turn negative.

Additionally, borrower-friendly definitions of EBITDA will impact the next restructuring cycle by allowing distressed companies to potentially redirect cash and assets in a manner that may impair loan recoveries. Definitions of EBITDA have shifted far away from an objective accounting standard to a negotiated concept allowing borrowers to report EBITDA with generous add-backs. These add-backs allow a borrower to include projected cost-savings and synergies (in the context of acquisition financing) that have not yet been realized and sometimes projected revenue and revenue enhancements. Many of these add-backs are uncapped and both subjective and speculative. Borrowers are therefore reporting EBITDA expectations, as opposed to historical results. This type of reporting can distort the perceived financial health of the borrower. As a result, a stressed borrower (relying on an inflated EBTIDA calculation) might be able to pass a financial covenant test, incur additional debt, make a dividend to its equity holders or take other actions that otherwise would be prohibited. Thus, the next cycle will likely feature fully leveraged balance sheets with secured lenders facing an increased risk for collateral leakage, which means little to no recovery for junior lien holders and general unsecured creditors. As a result, we are likely to see aggressive litigation tactics by out-of-the money creditors with nothing to lose and whose fees (to the extent incurred by an official creditors’ committee) are paid for by the company and put additional risk on the existing lenders.

Finally, another concern in the current landscape relates to the borrower’s ability to move collateral beyond the reach of existing lenders through liability management strategies, such as transfers to unrestricted subsidiaries. These provisions effectively allow collateral to leave the system, impairing the recovery of creditors. While these maneuvers have grabbed headlines in the larger syndicated market (for example, J Crew and PetSmart), the next restructuring cycle may see these tactics deployed in the middle market.

"Dry Powder"

The mountain of dry powder that is driving a proliferation of private credit loans, may also impact future restructurings. While the secondary market for middle market loans has historically been limited (at least compared to the robust liquidity enjoyed in the syndicated loan market), pressure to deploy capital may well mean that lenders may be willing to put money to work in distressed situations, creating a greater depth of liquidity for potential secondary market buyers. We also can expect to see some private credit capital redirected to fund DIP and exit loans, especially in situations where existing lenders are unwilling or unable to advance new money, creating a more robust market in that space. Furthermore, private equity sponsors also have enjoyed a decade of fundraising and are sitting on vast sums of uninvested capital themselves. Thus, it is reasonable to expect many sponsors will try to help their portfolio companies weather the storm by providing the necessary equity cures/rescue financing (perhaps in partnership with their direct lenders) to bridge a restructuring and protect their invested capital.

"Restructuring Flexibility"

The next restructuring cycle will also see a continuation of the trend of debt-for-equity swaps (whether out of court, through a bankruptcy sale or in a chapter 11 reorganization plan). In large part, this trend stems from the fact that private credit funds generally have the flexibility (which banks and CLOs that dominated previous restructuring cycles simply do not) to acquire ownership by converting debt to equity and have available resources to provide operational and restructuring expertise to execute a turnaround plan.

Conclusion

Without question, the meteoric rise of private credit funds has had a profound impact on loan terms. Indeed, the resulting surge in borrower friendly documentation may significantly impede recovery in any future downturn. However, as borrowers and lenders brace themselves for a pronounced shift in the economic environment, it is also clear that private credit funds will have the potential to play a meaningful and proactive role in the next restructuring cycle.

________________________

*Source: https://www.spglobal.com/marketintelligence/en/solutions/leveraged-commentary-data