Heard on the Conference Room Floor

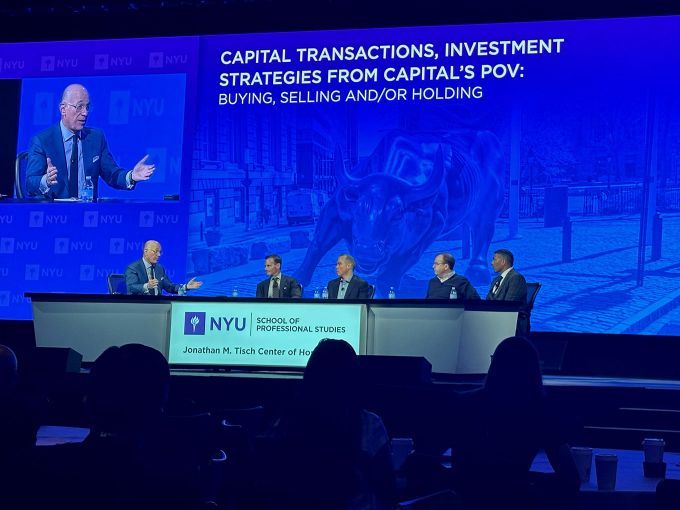

Earlier last week, Proskauer’s Jeff Horwitz, Yuval Tal, Steve Lichtenfeld, Rob Shmalo, Kris Herrmann and Lara Miller attended NYU’s 45th Annual International Hospitality Industry Investment Conference. During this two-day event, major themes emerged around the cost of financing, immigration, impending recession, leisure travel, distressed markets, and deal activity. On day one, Jeff Horwitz moderated heavy-hitting panel: Investment Strategies from Capital’s POV: Buying, Selling and/or Holding, while on day two, Yuval Tal lead C-suite lodging workshop: Lifestyle Hotels: Everything Everywhere All at Once. Sentiment was generally positive around consumer travel and lodging however, headwinds still prevail around labor and financing constraints. Please click below for a full recap on the team’s key takeaways.

It’s a People Business. The public company CEOs and the private equity owners were unanimously in favor of immigration reform. They are all in desperate need of additional supply of hotel workers. The GIG economy is cannibalizing the available hourly workers. With wages 30%-35% higher than pre-COVID (though starting to stabilize) and the continual labor shortage, operators have been doing more with less and leaning into technology and automation.

CEOs are Upbeat. Lodging CEOs were optimistic that Millennials and Baby Boomers have permanently shifted their spending toward travel/experiences and away from durable goods. They view this as a permanent structural shift. U.S. Leisure growth slowed to a halt in Q2 (notably resorts have been down, while urban leisure is still growing). At the same time, some described demand as fully intact, moving up against an abnormally strong post-pandemic period in Q2; others called it a normalization due to middle- and lower-income travelers having less cash to spend this year due to inflation, less pent-up demand, return to cruise travel, and more Americans returning to Europe. At the high-end, several operators noted that pricing inelasticity seen post-pandemic and up through last year has cooled some. Airfares are also eating into available travel spend. Business travel is the slowest to come back at 71% of pre-pandemic levels; leisure travel is making up for this deficit.

Debt Markets Remain Challenged. High borrowing costs are leading brands to focus on repositioning assets and conversions, as opposed to new developments. Construction financing remains difficult and when sourced, its at premium rates.

- Sub $50M lending market is strong and anything over $100M is very challenged.

- Blended rates for hotel loans are in the 9% range- roughly twice the rates then what could have been obtained pre-COVID.

- Banks are generally out of the hotel lending business. Private credit and CMBS are pretty much the only game in town.

- Banks could not adjust fast enough to the rapid increase in the Fed Funds Rate. One panelist noted that a hotel owner waiting for the banks to come back could be waiting a very long time.

- Private credit believes this is their moment. Fourteen percent returns sitting at 65% LTV in the capital stack looks like super-attractive risk-adjusted return.

- Development funding is at a trickle, which will constrain supply. Cost to build is up ~ 30% over the past two years.

There is Distress. Interest rates 9% or higher, are going to flush poor performers from the market and deal activity will start percolating at the maturity of loans. If a hotel trades at an 8 cap the owner needs to improve performance to escape the negative leverage. The days of making money off positive leverage and cap rate compression are in the rearview mirror – and likely for at least the next 5 years. Park Hotels & Resorts defaulted on $725M of debt secured by the Hilton San Francisco Union Square and Parc 55 San Francisco.

The Deal Environment is Poised to Recover. Deals are likely to regain velocity in the next 6‑9 months with one big deal (Ryman’s acquisition of BREIT’s JW Marriott Hill Country) announced during the conference. Private Equity remains on the sidelines as levered buyers given the higher cost of capital. Lodging REIT stock prices remain depressed with one former REIT CFO noting his own former company’s stock trading at the same level during the peak of COVID despite EBITDA being 30% higher. Significant discounts are also being found in the secondary market for hotel-oriented Private Equity funds.

The Swiftie Effect. On Monday morning’s panel moderated by Proskauer’s Jeff Horwitz, Tyler Morse, chairman and CEO of MCR, discussed the impact of Taylor Swift’s tour on lodging rates which will increase RevPAR 1% in 2023. Morse noted that his Scottsdale hotels commanded a $950 rate for the Taylor Swift concert and only a $450 rate for the Super Bowl and the Waste Management golf tournament.

Holding their Feet to the Fire. Brands are experiencing an increase in requests to provide their DEI and ESG stats, and most notably from the group travel segment. Lodging operators are having to answer to real property owners, customers and investors on their ESG and DEI standards and are taking this very seriously.

What Recession. Currently STR assumes a recession later than currently predicted with a peak-to-trough GDP decline of 1.5% and a 140-point increase in the unemployment rate. RevPAR growth is forecasted to be about 5% annually through 2025 split 2/3 ADR and 1/3 occupancy. A downturn could be different for the hotel industry given lowish unemployment therefore, providing more spending opportunities for Americans to continue to travel. The greatest concerns for leisure appear to be in super-luxury and for middle-class Americans continuing to feel the impact of inflation.

Dinner Highlights

Last Sunday, we were thrilled to kick-off this year’s conference by hosting clients and friends with a special dinner event at New York City’s renowned Lincoln Ristorante. It was a fun (and delicious) evening and we enjoyed getting together with everyone.