The European Securities and Markets Authority (“ESMA”) has published its Final Report on the Guidelines on funds’ names using ESG or sustainability-related terms (the “Guidelines”). ESMA was provided with the mandates to develop guidelines on unclear, unfair or misleading fund names in the updated Alternative Investment Managers Directive[1] (“AIFMD”) and UCITS Directive, which are now in force.

We cover here the funds that are intended to be in scope of the Guidelines, what the Guidelines entail and their proposed timing.

From the outset, we note that Member States must implement the Guidelines and there is the potential that the approach to such implementation may vary in terms of how embedded they are in regulatory regimes and how strictly they may be applied.

Which funds are in scope?

All alternative investment funds (“AIFs”) that are managed by EU alternative investment fund managers (“AIFMs”) alongside UCITS managed by UCITS management companies are in scope. ESMA has estimated that around 1,702 EU-domiciled AIFs will be affected by the new rules.

The Guidelines do not directly address the applicability of non-EU managers marketing funds in the EU under the AIFMD’s national private placement regimes. However, we do note that the mandate for ESMA to produce the Guidelines is in Article 23 of AIFMD, which covers the disclosures needed for investors for both EU AIFs and those marketed into the EU. Further clarity on this position may be provided by local regulators in the Member States as we cover under “Are the Guidelines mandatory?” below.

What do the Guidelines require?

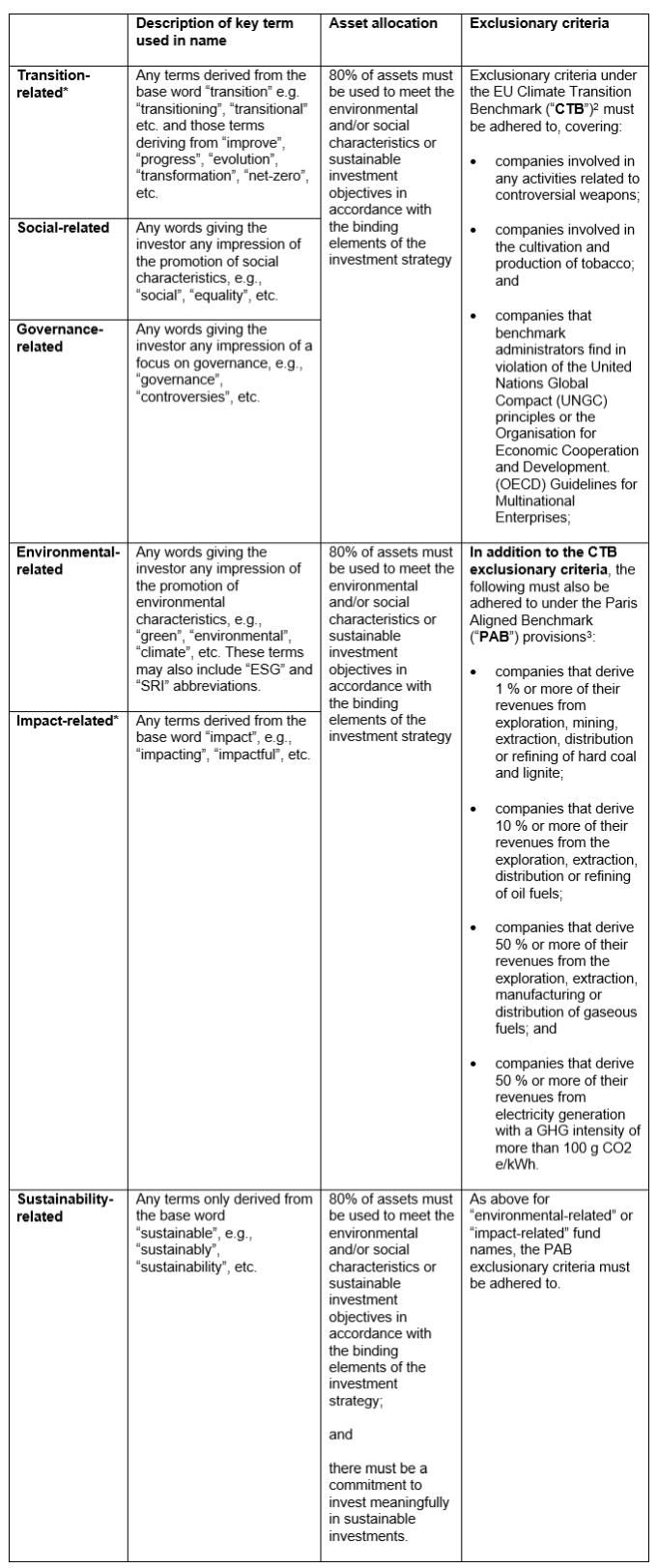

The Guidelines include thresholds for asset allocation and exclusionary criteria that varies dependent on the ESG or sustainability-related term used in the name. We have summarised the Guidelines here:

*What are the additional recommendations for “transition-related” or “impact-related” named funds?

Funds using “transition-related” or “impact-related” terms in their names should also ensure that the investments used to meet the thresholds specified are on a clear and measurable path to social or environmental transition or are made with the objective to generate a positive and measurable social or environmental impact alongside a financial return.

The aim is to create an additional qualifying link between the strategy and fund name, ensuring there is a measurable dimension to the strategy itself.

What is meant by “meaningfully” investing in sustainable investments?

Previously ESMA had suggested a 50% threshold for sustainable investments in the “sustainability-related” name category, however, this has been replaced with “meaningfully” investing in sustainable investments. ESMA sets out that as the “sustainability-related” fund name can apply to either (1) funds disclosing under Article 9 Sustainable Finance Disclosure Regulation (“SFDR”); (2) funds disclosing under Article 8 SFDR which in part invest in economic activities that contribute to environmental or social sustainable investment objectives; and (2) funds disclosing under the Taxonomy-Regulation, that there should be flexibility and no firm threshold. However, whatever the commitment is to sustainable investments, ESMA notes that this should be met by financial products at all times. Asset managers will need to consider carefully their judgement of what “meaningfully” is.

What is meant by the “binding elements of the investment strategy”?

As noted above, the threshold recommendations for asset allocation refer to being linked to the “binding elements of the investment strategy”. There is a requirement in the mandatory templates of SFDR Article 8 and 9 pre-contractual disclosures to commit to the binding elements of the ESG or sustainability-related investment strategy. “Binding elements” means those elements of the investment strategy that apply to environmental and/or social characteristics promoted or sustainable investment objective that cannot be overridden with discretion and apply to the “whole holding period”[4].

Why does the exclusionary criteria vary dependent on the fund name?

ESMA has taken the view that for funds using “environmental-related” or “impact-related” terms in their names, it is reasonable for investors to expect that there would not be significant investments in fossil fuels and therefore the PAB exclusionary criteria should be followed. However, for the “transition”, “social” and “governance“ related fund names, ESMA has the view that these categories should not penalise investment in companies deriving part of their revenues from fossil fuels — in the case of “social” and “governance” related names any environmental considerations may not be the focus and for “transition” related names the strategy could be in investments fostering a path to transition towards a greener economy, including those with fossil fuels as part of their revenue base.

What kind of assets do the exclusionary criteria apply to?

The exclusions apply to “companies” regardless of how investment in those companies are made or which financial instrument those companies may issue, for example, they cover bothequity and debt investments. There is no guidance on whether the Guidelines should be applied on a look-through basis for any fund of funds or for any real assets or other non-investee company asset classes.

What is the application of the Guidelines to closed-ended funds?

ESMA noted the feedback that respondents had provided on closed-ended funds, including that as they are no longer open for distribution, they should have no need to adhere to the naming-related provisions as they are not being marketed or sold to investors. ESMA also details the feedback that respondents set out there would be little rationale in applying the provisions, as it would be seen as an inappropriate retroactive change.

However, despite the feedback, ESMA has sets out that the Guidelines are intended to apply without distinction to either open- and closed-ended funds. ESMA is of the view that it would be “meaningful” to ensure that the name of the fund matches with the underlying investments even for investors in a closed-ended fund (including existing investors).

Whilst this initially appears far-reaching in scope, the capture of closed-ended funds is not directly addressed in the Guidelines themselves and it will be up to individual Member State regulators as to how the Guidelines will be approached, as we set out under “Are the Guidelines mandatory?”. We recommend that asset managers with ESG or sustainability-related named closed-ended funds keep a watching brief on the Member States’ implementation of the Guidelines for a firmer position on the expectation for such funds.

Are the Guidelines mandatory?

Within two months of the date of publication of the Guidelines on ESMA’s website in all EU official languages, the competent authorities (local regulators) must notify ESMA whether they (i) comply; (ii) do not comply but intend to comply; or (iii) do not comply and do not intend to comply with the Guidelines. In case of non-compliance, the competent authorities must also notify ESMA within two months of the date of publication of the Guidelines the reasons for non-compliance.

Local regulators are tasked with making every effort to comply with the Guidelines and to incorporate them into their national legal and/or supervisory frameworks and ensure through supervision that financial market participants comply with the Guidelines. However, the optionality of confirming compliance, the nature of them being termed “Guidelines” and that scoping points such as on closed-ended funds and non-EU AIFMs marketing into the EU are not covered in the Guidelines themselves means there is a watch and wait for how each Member State approaches the implementation of the Guidelines. There could be a variety of approaches to how deeply the Guidelines are embedded and how broadly they are applied in regulatory regimes.

Nevertheless, for EU funds moving forwards with new ESG or sustainability-related fund names, we do recommend that the Guidelines are factored into strategy considerations.

What are the supervisory expectations?

There is a broad range of supervisory expectations set out in the Guidelines, which may provide some reassurance to asset managers on a proportionate approach being encouraged to be taken by regulators in relation to the Guidelines. They include that a temporary deviation from the threshold and exclusions should be treated as a passive breach and corrected in the best interest of the investors, provided it was not deliberate by the asset manager. “Further investigation” and “supervisory dialogue” is also recommended to be considered where:

- there are discrepancies in the level of the quantitative threshold which are not passive breaches;

- there is a fund that does not demonstrate sufficiently high level of investments to use the transition-, ESG-, impact- or sustainability-related terms in its name; or

- where the competent authority considers that using transition-, ESG-, impact- or sustainability-related terms in the fund name would result in investors receiving unfair or unclear information or in a failure of the manager to act honestly or fairly thus misleading investors.

However, there is no specific enforcement action or penalties recommended in the Guidelines.

How do these fund name Guidelines relate to any categories introduced as part of SFDR 2.0?

SFDR is currently under consultation which we have reported on most recently here, which has sought feedback on the introduction of categories and a labelling system funds. ESMA notes that “SFDR may take many years to complete, while greenwashing risks in funds need to be addressed in the present”. ESMA further sets out that it “supports labels but these would require legislative changes and they will require a long time to be implanted and will not help tackling the issue at stake in an urgent manner”. This is potentially useful insight into the timing of any SFDR developments and can be read that the market must work with the current SFDR disclosure regime and these additional Guidelines rather than expect any imminent wholesale change with SFDR 2.0.

When do the Guidelines apply?

They will apply three months after the date of the publication of the Guidelines on ESMA’s website in all EU official languages. ESMA sets out that managers of any new funds created after the date of the application of the Guidelines should apply the Guidelines immediately in respect of those funds. For managers of funds existing before the date of application of these Guidelines they should apply the guidelines in respect of those funds after six months from the application fate of the Guidelines (nine months in total). However, as noted under “Are the Guidelines mandatory?” there could be variations in approaches to timing and scope under the individual Member State implementation of the Guidelines.

What are the next steps?

We recommend that asset managers keep a watching brief when the Guidelines are published in all EU official languages on the ESMA website and the individual Member State implementation of the Guidelines for clearer direction on how strictly the Guidelines will be applied and how widely in terms of funds managed by non-EU AIFMs and closed-ended funds.

For AIFs managed by EU AIFMs we do recommend that the Guidelines are considered in strategy setting moving forwards where there might be an ESG or sustainability-related name.

For more information please reach out to ukreg@proskauer.com

[1] For our article on AIFMD II, please see: AIFMD 2.0 – Evolution Rather than Revolution – Insights – Proskauer Rose LLP

[2] Article 12(1)(a)-(c) of Commission Delegated Regulation (EU) 2020/1818

[3] Article 12(1)(a)-(g) of Commission Delegated Regulation (EU) 2020/1818

[4] JC 2023 18 – Consolidated JC SFDR Q&As (europa.eu) – Question 2 – Answer provided by the European Commission on the interpretation of the SFDR, published on 14 July 2021 and Recital 11 of Commission Delegated Regulation (EU) 2022/1288