On 4 December 2023 the European Supervisory Authorities (the “ESAs”) published their final report on updating the regulatory technical standards of the Sustainable Finance Disclosure Regulation (“SFDR Level 2”).

The updates proposed will vary in impact depending on a fund’s strategy, particularly impacting if there is any commitment to greenhouse gas emissions reduction or if there are any sustainable investments due to updates to the do no significant harm disclosures. For those asset managers automatically caught or opted into the entity-level principal adverse impact (“PAI”) reporting regime, the updates to the PAIs will also be significant. Many of the updates to the PAI indicators and their formulae or metrics are to align with the EU’s Corporate Sustainability Reporting Directive’s European Sustainability Reporting Standards (“ESRS”).

However, for all SFDR Article 8 or 9 funds it is likely that new pre-contractual and periodic reporting templates will need to be used from a certain date should the European Commission agree with the proposals and they are quite substantially updated, which will require time and resources to adapt to.

With regards to timing, the European Commission now has three months to consider the report and decide whether to adopt the updates. In terms of broader context, the European Commission’s two SFDR consultation papers, which closed for feedback on 15 December, also steer the course for further updates to SFDR’s disclosure requirements, and asset managers may therefore be navigating these new templates and updates as proposed by the ESAs and then further, more fundamental change following the European Commission’s consideration of feedback on SFDR. Our update on the consultation papers is found here.

We set out a summary of the key changes in the ESAs’ report below, with our key three takeaways as follows:

- PAI thresholds and criteria of “harm” will need to be disclosed on websites when considered in DNSH for sustainable investments, when previously these have remained confidential;

- Committing to GHG emissions reductions at financial product level now requires careful consideration of new disclosure requirements, including calculations and interim targets; and

- The pre-contractual and periodic templates and website disclosures are substantially different in look and feel as well as with some key content updates – time and resource will be required to adapt to the new disclosure requirements.

“Do no significant harm” updates

A significant update is that the ESAs propose that there is a requirement to disclose the thresholds or criteria for the PAI indicators that a financial product uses to determine that its sustainable investments comply with the DNSH principle in the website disclosures. Previously these thresholds have not required to be published and may open up asset manager’s approaches to sustainable investments to additional scrutiny.

A further update proposed to be enshrined in SFDR Level 2 by the ESAs reflects the European Commission Q&A guidance of June 2023 that confirmed that Taxonomy-aligned economic activities would automatically be considered sustainable investments.

‘Simplification of the templates’

The ESAs set out there has been a simplification of the language and structuring of the information provided in SFDR disclosures. This is proposed to be achieved via a “dashboard” to provide key information in the first page of the documents, alongside more detailed disclosures on the following pages. The dashboard is designed to attract readers’ attention to critical information and reduce information overload while still offering detailed data for sophisticated investors.

The dashboard highlights whether a financial product has a sustainable investment objective or promotes environmental/social characteristics and includes information on sustainable investments, Taxonomy-aligned investments, PAIs, GHG emissions reductions targets. The description of the GHG emission reduction target is framed as “aiming” to reduce which is intended to differentiate between products with such an aim and Article 9(3) SFDR financial products with a specific decarbonisation investment objective.

There is also intended “click through” functionality from the dashboard into the longer disclosures that follow on from it.

Overall, whilst the updates may be promoted as “simplification,” asset managers have spent several years and considerable resource meeting the existing SFDR Level 2 disclosure requirements. The updated approach is not insignificant and will require further time and care to ensure compliance with these updated templates, if ultimately approved.

Amendments regarding GHG emissions reduction targets

There are updated pre-contractual, website and periodic reporting requirements on GHG emissions reduction targets, including intermediary targets and milestones, where relevant, and actions pursued. The aim of the updates is to help deliver on the European Commission’s objective to improve target-setting, disclosure and monitoring of the financial sector’s commitments to the transition to a sustainable economy. If a product is not committed to GHG emissions reduction targets, the new set of disclosures will not apply.

In summary, the requirements incorporate the following:

- a maximum interval of five years between targets – this is also to align with ESRS E1 and the Paris Agreement

- there is a choice of whether the GHG emissions reduction will be achieved:

- after the initial security selection, the financed GHG emissions of the product will be reduced through portfolio reallocation – divestment from assets with particular GHG emissions level and investment in assets with comparatively lower GHG emissions (excluding relatively higher-emitting assets from the portfolio would achieve a reduction in financed emissions, even if in parallel no emissions reduction has been achieved in the real economy); and/or

- the financed GHG emissions of the product will be based on the delivery of the actual GHG emissions reductions at asset level over the duration of the investment either by investing in assets expected to deliver GHG emissions reductions over the duration of the investment or by engaging with investee companies.

- In pre-contractual documents, there is a requirement to disclose on type of outcome the product is omitting to achieve, the level of ambition of the target, in particular in aligning with the Paris Agreement, and to explain how the strategy will help deliver on the target(s)

- in periodic reports, there is a requirement to report on progress to date and explain how the investment strategy contributed to such progress. Periodic reports should also identify the potential delays in achieving the target(s) and potential adjustments needed.

- in website disclosures, there will be more detailed, supported GHG emissions information disclosed, as cross-referenced to in the pre-contractual and periodic reports

- there is encouraged use of the Partnership for Carbon Accounting Financials (“PCAF”) Standard for measuring financed GHG emissions baseline and monitoring progress, as well as to set targets. This also aligns with ESRS E1.

- reductions targets should be set based on all relevant investments which would include sovereign bonds, however, there are separate disclosures to separate out all other asset classes from sovereign bonds

- the draft SFDR Level 2 requires asset managers to be transparent about the share of the investments for which gross GHG emissions (i) was reported by underlying investee undertakings, (ii) was retrieved from investee companies or (iii) could be estimated and disclose this on website disclosures. This is in recognition that reliability of scope 3 emissions data remains to be evolving.

- there is recognition that there is target based volatility in AuM and EVIC based calculations metrics (as well as further metrics) and therefore there is the provision for adjusted metrics on website disclosures, together with the adjustment factor used, and an explanation of how this was constructed and applied

- GHG removals and storage, carbon credits or avoided emissions implemented by investees companies/financed projected cannot be relied upon as a means of achieving the GHG emissions reduction targets at product level. However, carbon credits can be disclosed on in periodic reports in a separate disclosure and on website disclosures there should be confirmation that the carbon credit is recognised as per the quality standard in the ESRS Annex 2.

Changes to PAIs

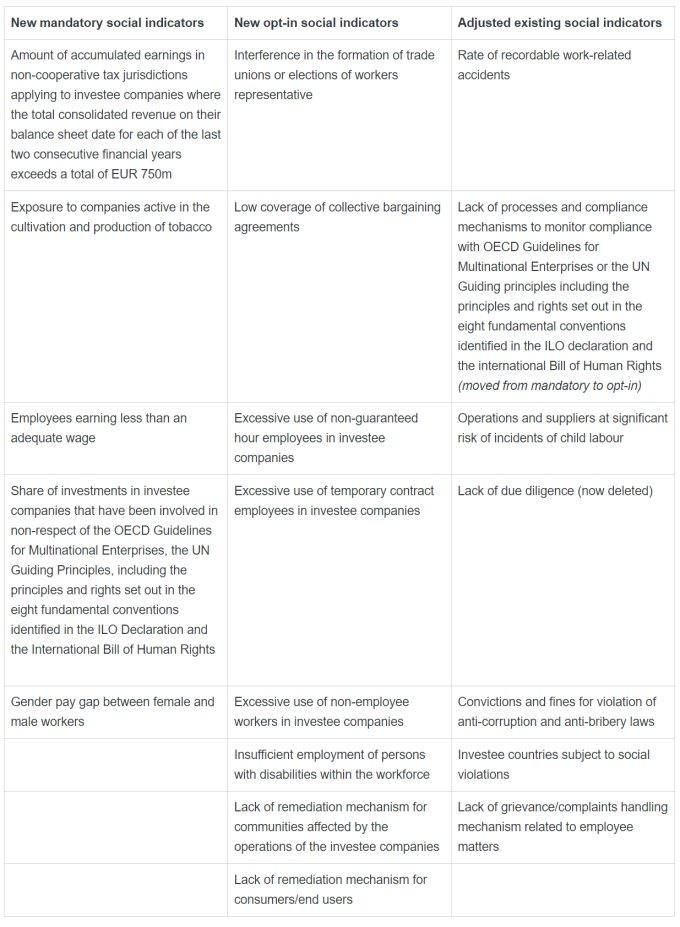

There are new mandatory social indicators, as well as new opt-in social indicators and certain changes to existing indicators, as follows. Many of the updates are to align the PAIs with the ESRS, which may be welcome to asset managers trying to align sustainability metrics across their business.

In addition, there have been updates to the following existing environmental indicators. The majority of the updates are to reflect how to measure or account for an indicator and again there is alignment with the CSRD ESRS in:

- Carbon footprint

- GHG intensity of investee companies

- Exposure to companies active in the fossil fuel sector

- Energy consumption intensity per high impact climate sector

- Share of non-renewable energy consumption and production

- Emissions to water

- Hazard waste and radioactive waste

- Deforestation

- Sovereign GHG intensity

Changes to the PAI framework

There were multiple changes to the PAI framework that were considered by the ESAs, with some resulting in updates others not pursued, as follows:

- All versus relevant investments: the ESAs have retained the requirement for PAIs to be calculated at entity level base on “all investments.”

- Treatment of investee companies’ value chains: in alignment with the ESRS where an investee company reports on their value chain, then the value chain of that investee company should be included in the PAI calculation.

- Disclosure of share estimates: the ESAs have added to SFDR Level 2 that PAI entity-level disclosures include the share of the adverse impact based on data from the investee company and what was estimated or subject to reasonable assumptions.

- New formulae and adjustments to existing formulae and technical changes or clarifications: have been adjusted to reflect the changes in the indicators.

- Treatments of derivatives in PAI disclosures: derivatives should be converted to economic exposure. However, other provisions in relation to derivative transactions that do not result in a physical exposure that were consulted on have not been pursued in updates by the ESAs at this stage.

For further information or for copies of the updated disclosure templates, please reach out to UKreg@proskauer.com