As mentioned in our latest briefing note, the UK Financial Conduct Authority (FCA) published its final rules and guidance (the “Rules”) setting out the requirements under a new climate-related disclosure regime for certain asset managers and advisers as well as certain “asset owners” (i.e. life insurers and FCA-regulated pension providers) in December last year. The rules, which were published in policy statement (PS21/24) are aligned with the Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD).

Who do the Rules apply to?

The Rules will apply only to firms authorised by the FCA and which carry out “TCFD in-scope business”. This broadly divides into two categories:

- Asset managers – which covers:

- Firms which manage investments (this would include carrying on portfolio management under the Markets in Financial Instruments Directive (MiFID) as onshored in the UK;

- Firms which carry on private equity or other private market activities consisting of either advising on investments on a recurring or ongoing basis in connection with an arrangement the predominant purpose of which is investment in unlisted securities (this could include a UK authorised firm what provides investment advice to a fund manager);

- UK AIFMs managing Alternative investment funds (AIFs); and

- UK UCITS management companies managing a UK UCITS.

- Asset owners – which covers:

- life insurers or pure reinsurers which provide insurance-based investment products or operate personal pension schemes or SIPPS (in relation to SIPPs containing insurance-based investment products provided by the firm); and

- other asset owners (other than insurers or pure reinsurers) which operate a personal pension schemes (excluding a certain kinds of SIPPs) or stakeholder pension scheme.

As explained in the “When do they apply?” section, the new requirements will only apply to firms exceeding certain funds under management or administration thresholds.

Are non-UK firms in scope?

As specified above, the Rules directly impact UK FCA-authorised firms, so do not apply to non-UK managers that manage AIFs which are marketed in the UK in the same way the EU sustainable finance disclosure Regulation (SFDR) captures non-EU managers. However, the FCA has stated that it is considering further how overseas funds marketed into the UK should be treated as part of the forthcoming Sustainability Disclosure Requirements (SDR). Accordingly, it is possible that the scope of the Rules could eventually apply to non-UK asset managers marketing their funds in the UK under the NPPR in the future.

When do they apply?

The Rules have started to apply from 1 January this year for the largest firms with more than £50 billion in assets under management (or £25 billion assets under administration for asset owners) and are implemented in a new Environmental, Social and Governance (ESG) sourcebook contained within the FCA Handbook. The first set of reports for these firms will be due by 30 June 2023, reflecting the 2022 calendar year.

Remaining firms, with assets greater than £5 billion (such threshold to be reviewed after three years of disclosures), will be subject to the new rules from 1 January 2023, with the first set of annual reports for the calendar year ending 2023 due by 30 June 2024.

What are the requirements?

The new regime will require in-scope firms to make disclosures on an annual basis at:

- Entity-level—

- an annual TCFD entity report published in a prominent place on the main website of the firm setting out how the firm takes climate-related matters into account in managing or administering investments on behalf of clients and consumers;

- the contents of the report must be consistent with the TCFD’s recommendations with disclosures required on (i) governance regarding climate risk and opportunities; (ii) strategy (including scenario analysis) regarding the same; (iii) risk management of climate risks; and (iv) metrics and targets used to assess and manage climate risks and opportunities. Firms that have set a climate-related target must provide detailed disclosures on their target, KPIs and how the measure progress. Where firms have not set such targets they must explain why that is the case; and

- in addition, the entity level report must include a statement signed by a member of the firm’s senior management, confirming that all the disclosures (including any of those cross-referenced from other group or third party entities) comply with the FCA’s disclosure requirements.

- Product-level—

- disclosures to be made (including a core set of climate-related metrics) which are closely aligned to the EU SFDR Principle Adverse Impact metrics. Disclosures must appear on the firm’s products and portfolios, must be made publicly available in a prominent place on the main website of the firm and included or cross-referenced in an appropriate client communication or made on request to certain institutional clients; and

- disclosures on products must also be made available to clients on demand, where clients require them for their own climate related financial disclosure obligations under any applicable law. The Rules will require firms to provide a report to clients at a single reference point consistent with public disclosures, or at a date agreed between the client and the firm, provided in a ‘reasonable’ format.

Further UK ESG Requirements on the Horizon?

In October last year, the UK government set out its strategy to achieve further sustainable investment goals which align with its strategy to meet the UK’s 2050 net zero carbon emissions target.

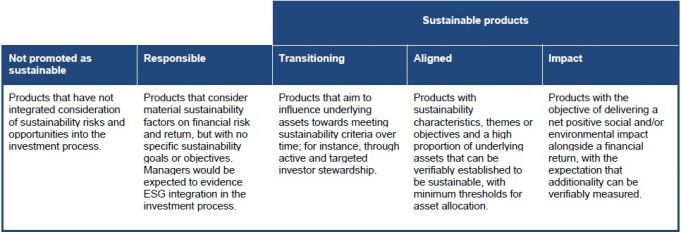

Further proposals were made in November 2021 with the publication by the FCA of its discussion paper (DP21/4) on Sustainability Disclosure Requirements and investment labels. The key aspect of the product labelling system will see a new product classification and labelling system where products will be designated as ‘not sustainable’, ‘responsible’, ‘transitioning’, ‘aligned’, or ‘impact’ products. Products must meet the criteria for ‘transitioning’, ‘aligned’ or ‘impact’ products in order to be labelled as ‘sustainable’, whereas products with lower ESG ambitions may be labelled as ‘responsible’. The table below sets out the FCA’s proposed labelling regime for financial products:

The proposed product level sustainability disclosures apply at a level targeted more to a retail consumer base and includes a more detailed supplementary layer in circumstances where the product is aimed at professional investors.

Wider, customer-focused disclosures

The wider, customer-focused disclosures proposed in the DP include the following:

- investment product labels;

- objective of the product, including specific sustainability objectives;

- investment strategy pursued to meet the objectives, including sustainability objectives;

- proportion of assets allocated to sustainable investments (including alignment with the UK Taxonomy);

- approach to investor stewardship; and

- wider sustainability performance metrics.

Additional disclosures for institutional investors

The proposals contained the following additional product level disclosures aimed at professional investors:

- information on data sources, limitations, data quality etc.;

- providing further support to the relevant narrative, including contextual and historical information;

- further information about UK Taxonomy alignment; and

- information about benchmarking and performance.

At this stage the FCA is still contemplating whether prescribed disclosure templates should be used, as is the case under SFDR. The FCA has stated that it intends to issue a consultation in Q2 2022 on proposed rules to implement the new SFDR framework.

UK firms in scope of the rules should start putting into place implementation projects, reviewing any available relevant data and should consider how gaps will be addressed to make the relevant disclosures. Firms will need to dedicate resources to ensure that they are able to comply with the various rules that have started to apply or will apply to them in the future.

The impact on non-UK firms will be monitored and reported on by Proskauer as we hear more about the FCA’s approach. For further information on any of the developments discussed in this briefing, contact our UK regulatory team.