The NY Climate Week conference took place during the week of 18 September 2023, bringing together international leaders from business and governments. During the conference the Taskforce on Nature-related Financial Disclosures (“TNFD”) officially launched its disclosure Recommendations (the “TNFD Recommendations”) and suite of additional guidance. This follows a two-year development process. As a global initiative it will be relevant to firms in Europe, North America and the rest of the World.

We set out below the (i) the TNFD’s relevance to fund managers and investment advisers, (ii) the background to the TNFD, (iii) key points from the TNFD Recommendations and (iv) next steps to be considered.

Why is TNFD relevant to fund managers and investment advisers?

The expected trajectory of the TNFD Recommendations is to mirror that of the Taskforce on Climate-Related Financial Disclosures (“TCFD”), where the TNFD Recommendations become regulatory reporting requirements for financial market participants, including fund managers and investment advisers, in a range of jurisdictions. For example, in the same manner TCFD recommendations are now a regulatory reporting requirement of the Financial Conduct Authority for many UK asset managers and owners.

Indeed, the expectation is that the TNFD Recommendations could be translated into regulation even faster, as the TCFD has already laid the groundwork for this process. Evidence of this is that the standard setter of the International Sustainability Standards Board (“ISSB”), which has published its global non-financial corporate reporting standards, has confirmed it will integrate the TNFD Recommendations into its requirements. The UK has been a strong supporter of the ISSB standards and is currently undergoing an official assessment of them, before expected endorsement and adoption, which will result in the TNFD being applicable in the UK via the ISSB adoption. Similar processes are taking place in Canada, Australia, Japan, Hong Kong, Malaysia, New Zealand and Singapore. From a US perspective, the International Organization of Securities Commissions (“IOSCO”) has officially endorsed the ISSB. Both the US Commodity Futures Trading Commission and US Securities and Exchange Commission are members of IOSCO, and with the ISSB’s integration of the TNFD Recommendations, it is expected that the TNFD Recommendations will be on the US regulatory agenda too.

Beyond the fund managers and investment advisers’ likelihood for direct reporting on the TNFD Recommendations, there will also be either voluntary uptake or, in time, similar regulatory requirements for a broad range of portfolio companies to provide such nature-related reporting too.

What is the Taskforce on Nature-related Financial Disclosures?

The TNFD itself is a UN-backed coalition of businesses (including financial institutions), service providers and scientific experts. It was tasked with designing a framework for public and private companies to use, to assess and disclose nature-related impacts, risks and opportunities. The urgency to launch the TNFD Recommendations was heightened following almost 200 countries signing the Kunming-Montreal Global Biodiversity Framework in December 2022, which set aims such as conserving at least 30% of the Earth’s surface by 2030 and other nature-focused targets.

The TNFD Recommendations are designed to achieve increased reporting on nature, with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature‑positive outcomes.

What are the TNFD Recommendations?

In brief, the 14 recommended disclosures set out in the TNFD Recommendations leverage and utilize the four pillars of the TCFD: governance, strategy, risk management, metrics and targets.

The overall disclosure aims of the pillars are as follows:

Governance | Disclose the organization’s governance of nature‑related dependencies, impacts, risks and opportunities. |

Strategy | Disclose the effects of nature‑related dependencies, impacts, risks and opportunities on the organization’s business model, strategy and financial planning where such information is material. |

Risk & impact management | Describe the processes used by the organization to identify, assess, prioritize and monitor nature‑related dependencies, impacts, risks and opportunities. |

Metrics & targets | Disclose the metrics and targets used to assess and manage material nature‑related dependencies, impacts, risks and opportunities |

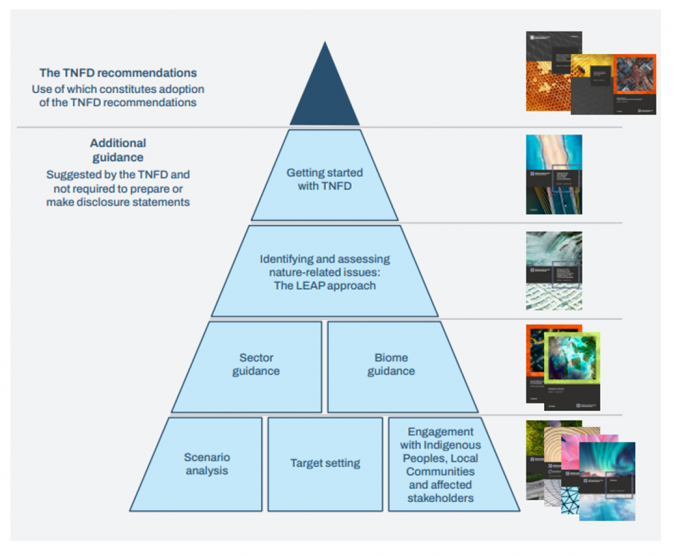

The TNFD has also published a suite of additional guidance to support in the preparation and reporting of the TNFD Recommendations.

There is synergy in the TNFD Recommendations not only with the TCFD, but also with other ISSB and EU reporting standards – for example, under the Corporate Sustainability Reporting Directive. With the increasingly vast amount of sustainability‑related reporting required by fund managers, investment advisers and portfolio companies, these efforts to harmonize the TNFD Recommendations with existing standards is welcome.

The TNFD has also published discussion papers on various areas, including value chains and sector specific metrics on which feedback is sought. Some further sector specific guidance will also not be published until COP28, held in December 2023 in the UAE.

Additional Guidance for Financial Institutions

For asset managers, of particular interest will be the Additional guidance for financial institutions (the “Guidance”). The majority of the Guidance is for a broad range of financial institutions including asset managers, asset owners, banks and insurers. However, there is some specific guidance for asset managers that will be of relevance for those in the private equity and venture capital industries. These include the following guidance points to support disclosures:

- an asset manager (or asset owner) should describe how nature‑related dependencies, impacts, risks and opportunities are factored into product development and investment or ownership strategy;

- a financial institution should describe, as relevant, how the organization’s risk functions (in the case of all institutions) and investment teams (in the case of asset managers and owners) monitor nature‑related dependencies, impacts, risks and opportunities in its direct operations and financial portfolios;

- risk metrics for financial institutions are set out to be metrics used to assess the potential for loss due to nature‑related risks, specifically with regard to investments for asset managers; and

- opportunity metrics for financial institutions are set out to be metrics used to track nature-related opportunities and specifically in relation to investments for asset managers – these will often be in the form of individual products or transactions, so can be disclosed as absolute amounts or relative to a portfolio total.

What should fund managers and investment advisers do now?

With the likely trajectory that the TNFD Recommendations will be translated into regulation in at least some jurisdictions in the coming years, we recommend that fund managers and investment advisers review and assess the viability of any potential adoption of the TNFD Recommendations early. Not only will this support with getting ahead of any legal requirement for nature-related reporting but will also provide more time to understand the nature-related indicators and metrics, that are undoubtedly more challenging to quantify and assess in comparison to greenhouse gases.

The TNFD’s key message in the launch was indeed to “get started” with some form of nature-related monitoring and reporting, even if not to fully meet the TNFD Recommendations. To support this the TNFD has published specific guidance to help kickstart any efforts, which we recommend as a valuable place to start (the “Getting Started Guidance”).

Furthermore, in recognition of the challenges on nature-related reporting, the TNFD has a published its “LEAP” assessment process. This would be the next step to take beyond reviewing the TNFD Recommendations and the Getting Started Guidance. The LEAP process aims to guide organizations on nature‑related risk and opportunity management through a four-step process. In summary, the four steps are:

- Locate proximity to environmental assets and services;

- Evaluate nature‑related dependencies and impacts;

- Assess scenarios and the nature‑related risks and opportunities; and

- Prepare to respond and report on metrics found.

In the launch of the TNFD Recommendations there was a specific ask from David Craig, Co‑Chair of the TNFD, for asset managers to publicly adopt the TNFD for their portfolio companies. Although this may be ambitious, we do recommend that the TNFD Recommendations and Getting Started Guidance is reviewed and on the agenda for fund managers and investment advisers as nature‑related reporting, despite its challenging metrics, seems set to be a legal requirement in years to come.

For any asset managers considering their next steps on TNFD reporting, please do reach out to UKRegulatory@proskauer.com for assistance.