Yesterday, the five SEC commissioners voted 3-2, along party lines, to approve the Private Fund Adviser Rules. The final Rules scale back from what was initially proposed 18 months ago, in ways that are likely to be a relief to many private fund advisers. (For a summary of the initial proposal, please see our previous Alert.) Even in their current form, however, the Rules still impose many new obligations and introduce new prohibitions that are likely to significantly alter business practices, and impose new administrative burdens and costs, across many registered and exempt private fund advisers. All private fund advisers should therefore review their practices in light of the new Rules in order to assess whether and how their practices and documentation will need to change before the Rules’ compliance dates.

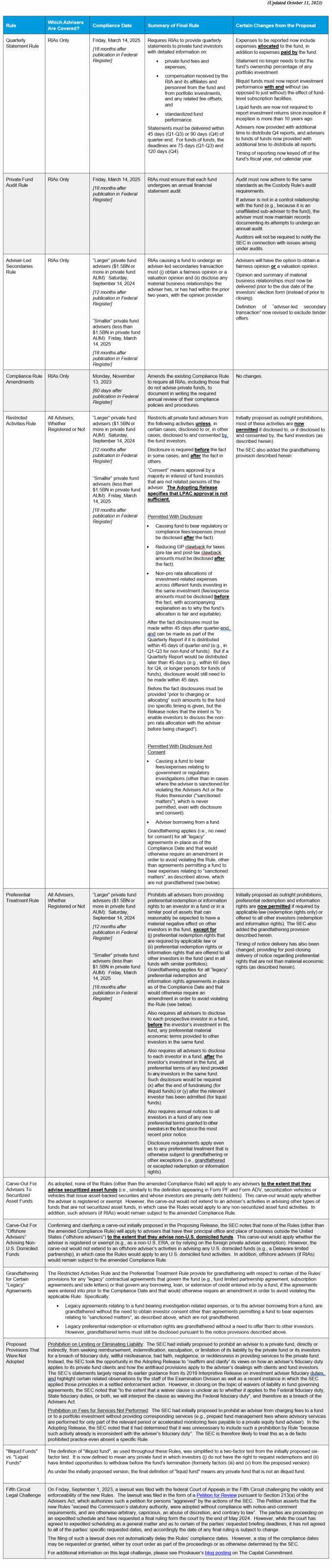

A summary of the Rules along with preliminary highlights appears below (to be followed by a more detailed summary in a forthcoming publication). Readers may also wish to refer to the SEC’s Fact Sheet regarding the final Rules, as well as the Adopting Release.