Introduction

Prior to the passage of the Tax Cuts and Jobs Act (the “Act” ), expenses incurred for the production of income (“investment expenses”) could be deducted under Section 212 of the Internal Revenue Code of 1986, as amended (the “Code”).1 These types of expenses included, for example, fees paid to family offices and/or investment advisors. The Act eliminated this deduction for the years 2018 – 2025. This loss may have significant adverse tax consequences for those individuals who pay such types of fees.

A recent case, Lender Management, LLC v. Comm’r (“Lender”)2, allowed a management company formed by the taxpayer to manage his family’s investments to deduct these types of expenses as “trade or business expenses” under Code Section 162 against the taxable income of the management company received on account of a “profits interest” in family investment partnerships. If a taxpayer’s facts are similar to those in Lender, it may be possible to create or even refine an entity structure that would support a position taken on a tax return that the investment expenses are deductible even under the law as revised by the Act.

Lender Facts

The Lender decision was very fact specific. Therefore, a careful review of those facts must be undertaken to understand how the Tax Court reached its decision.

Harry Lender founded Lender’s Bagels in 1927. Harry had two sons – Marvin and Murray – who worked with him in the business. Keith, Sondra, and Heidi were Marvin’s children. Marvin had four grandchildren – referred to in Lender as M.L., J.L., D.L., and E.L. Murray had three children – Carl, Jay and Haris. Murray had six grandchildren, referred to in Lender as A.L., R.L., J.R., O.R.L., D.L.C., and C.L.

Lender Management LLC (“LM”) was formed by the family in 1992. It was initially owned 99% by the Marvin Lender Trust and 1% by the Helaine Lender Trust. In 2010, the Keith Lender Trust (through assignment) owned 99% of LM and the Marvin Lender Trust owned the 1% of LM.

The operating agreement of LM provided that LM was to engage in the business of managing the “Lender Family Office” and to provide management services to Lender family members, related entities, and “other third-party nonfamily members.”3 These management services were provided to three limited liability companies (called “M&M”, “Lenco”, and “Lotis” – collectively referred to as “Funds” herein). The beneficial owners of the Funds were Harry’s children, grandchildren, and great-grandchildren.4 During the tax years at issue, Marvin held combined interests in M&M equal to 10.8% and in Lenco equal to 33.02%, and Keith owned less than 10% of M&M and less than 4% of Lenco.

M&M invested in private equity, Lenco invested in hedge funds and Lotis invested in public equities. Lotis merged with Lenco in 2010.

The LLCs were treated as partnerships for tax purposes. LM received a small fee based on net asset value from one of the partnerships5 along with a profits interest6 in each of the partnerships in exchange for the services it provided.7

Here is what LM did to earn its compensation:

- It made investment decisions and executed transactions on behalf of the Funds.

- It operated for the purpose of earning a profit – with its main objective to earn the highest possible return on assets under management.

- It provided individual investors in the Funds with one-on-one investment advisory and financial planning services.

- It employed Keith8 as chief investment officer, and he worked 50 hours per week at LM. Most of his time was spent researching and pursuing new investment opportunities, and monitoring and managing existing positions. He reviewed approximately 150 private equity and hedge fund proposals per year on behalf of the Funds. He met with investment bankers, hedge fund managers and private equity managers.

- LM met annually with the beneficial owners of the Funds. These meetings were held as group meetings but individual meetings were arranged for those owners who were unable to attend the group LM learned the risk tolerances for investment of each owner in the Funds and devised asset allocations taking those risk tolerances into account.

- LM also employed an unrelated person (“Employee”) to serve as CFO, COO and controller. She spoke to Keith three or four times each day and exchanged 10 – 50 emails with him each She managed cash flow and lines of credit to have cash available for capital calls needed for the Funds’ investments.

- LM hired an outside company to provide accounting and investment advisory services. That company spoke to Employee on a regular basis and prepared LM’s income tax returns, as well as quarterly financial reports for the Funds. Keith reviewed his investment research with professionals at that company before acting on those deals, and that company presented Keith with other investment opportunities. Sometimes Keith acted in accord with that company’s recommendations, and sometimes he did not.

For the tax years 2010 – 2012, LM deducted all of its expenses9 as trade or business expenses. The IRS disallowed the deductions, stating that LM was not in the trade or business of providing investment advisory services. The Tax Court disagreed and allowed the deductions as trade or business expenses under Code Section 162.

Trade or Business Expenses

To understand the Tax Court’s decision, one must first understand what constitutes a “trade or business” – and what does not. The Code does not define the term, but the cases direct that an examination of the facts is required in each case.

Here are some things we do know:

- To be involved in a trade or business, a taxpayer must do so with continuity and regularity. The primary purpose for engaging in the activity must be for income or profit. 10

- An investor who simply manages and monitors his or her own investments is not engaged in a trade or business.11

- A trade or business is more likely to be found to exist if the taxpayer receives compensation other than a normal investor’s return.12

- Investing or facilitating the investing of others’ funds may qualify as a trade or buiness.13

The Tax Court Determined that LM’s Expenses were Trade or Business Expenses In Lender, LM undertook its actions with continuity and regularity – and did so for the primary purpose of generating a profit. Though Keith (or entities through which he had an interest) was an investor in the Funds, he did not own a significant portion of each Fund – and neither did Marvin; therefore, they could not be seen as simply managing their own investments. The compensation LM received was other than a normal investor’s return (i.e., the profits interest). Indeed, it was a significant factor that LM received its income on account of its profits interest in the Funds that enabled the court to conclude that LM fits the factual criteria of engaging in a trade or business.

The Tax Court also recognized that due to the fact that investments were “all in the family” so to speak, greater scrutiny must be applied. 14 In the instant case, the court found this heightened scrutiny standard had been met, concluding that LM was operated in such a business-like fashion and, importantly, that the partners in the Funds were not obligated to have LM manage their investments as part of the Funds and could withdraw their investments at any time. The Tax Court also noted that the owners of LM only had only minority interests in the Funds, and that the different family members that invested in the Funds were treated as “different clients” and not as one single, family entity.

How Could Lender Help Clients Benefit from the Deduction under Code Section 162?

The benefits of being able to arrange family investments using a Lender-type structure are illustrated by the following examples:

Example One

Prior to the Act’s elimination of the deduction for Code Section 212 expenses, assume a taxpayer had $100 of income from investments. Assume the taxpayer paid $20 in investment advisory fees, and that the taxpayer was in a combined Federal and state 40% income tax bracket, not subject to the alternative minimum tax, and had exceeded the 2% floor for miscellaneous itemized deductions.

The taxpayer would deduct $20 against his $100 of income, leaving $80 of taxable income. His tax would be 40% of $80, or $32. The taxpayer is left with $48 ($100 minus the $20 fee paid and the $32 tax paid).

Example Two

Assume the same facts as Example One but without the Code Section 212 deduction because it has been repealed. The taxpayer has $100 of taxable income but the $20 cannot be deducted, so he owes $40 in tax. The taxpayer is left with $40 ($100 minus the $20 fee paid minus the $40 in tax).

Example Three

Assume the same facts as Example One but, here, the taxpayer forms a management company to provide investment advisory services. The taxpayer invests through Funds managed by the management company and the management company is compensated with a profits interest of 20% in each Fund.

The Funds show a $100 profit. Of that amount, $20 is earned directly by the management company from its profits interest in the Funds. Therefore, the taxpayer earns only $80 of income. He pays tax of 40% - or $32 – on that profit. The taxpayer is left with $48 ($80 - $32 of tax).

The management company has $20 of income, but it pays investment advisory expenses of $20 which it deducts under Code Section 162. The management company pays no tax.

Example Three places the taxpayer in the same place he was before the Act as illustrated by Example One.

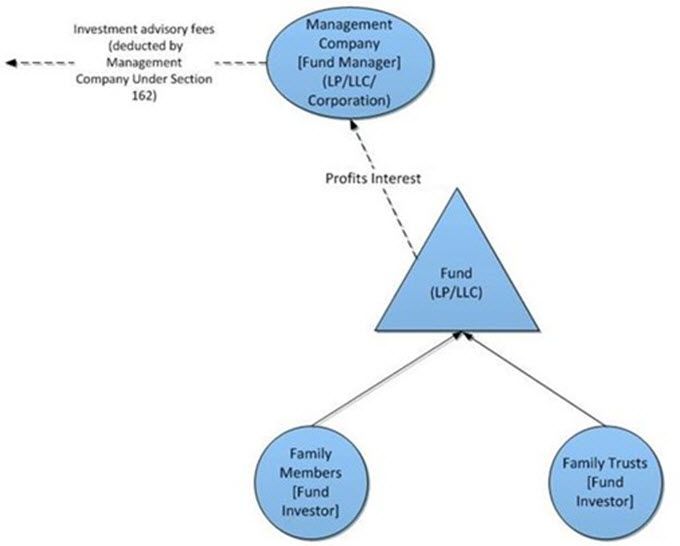

Diagram

A diagram illustrating the general form of the Lender structure appears below:

Concluding Thoughts

Lender is a fact-specific case which resulted in a significant win for the taxpayer. Taxpayers with family office and/or investment advisory expenses that might not otherwise be deductible due to changes in the law brought by the Act might consider organizing or reorganizing their affairs to attempt use the Lender decision as support for a deduction that would not otherwise be available.

This Client Alert is designed to give only general information on the developments actually covered. It is not intended to be a comprehensive summary of recent developments in the law, to treat exhaustively the subjects covered, to provide legal advice or to render a legal opinion.

1 There were certain limits that applied. A taxpayer subject to the alternative minimum tax could not take this deduction and this deduction was one of the “miscellaneous itemized deductions” that could be deducted only to the extent the total amount of miscellaneous itemized deductions exceeded 2% of a taxpayer’s adjusted gross income for the year.

2 T.C. Memo 2017 – 246 (December 13, 2017).

3 Though LM provided some services to third parties, it did not provide investment advisory services to them.

4 The actual owners of M&M were various Lender family trust and entities.

5 This fee was 2.5% from one of the partnerships after 2010.

6 The profits interest after 2010 was defined to be 25% of the increase in net asset value, annually.

7 The Tax Court noted that this structure was similar to a “hedge fund” structure.

8 Keith had an undergraduate business degree from Cornell and an MBA from Northwestern University. After joining LM, he took business classes at NYU and the Wharton Business School.

9 These included salaries and wages for family office-type services, as well as fees paid to the outside company that served as its investment advisor.

10 Comm’r v. Groetzinger, 480 U.S. 23 (1987).

11 Whipple v. Comm’r, 373 U.S. 193 (1963); Higgins v. Comm’r, 312 U.S. 212 (1941).

12 Whipple, supra.

13 Dagres v. Comm’r, 136 T.C. 263 (2011).

14 See, e.g., Estate of Bongard v. Comm’r, 124 T.C. 95 (2005). The court recognized that “transactions within a family group are subjected to a heightened scrutiny.”